As a beginner in Forex trading to use the Support and the Resistance effectively then you first need to understand the asset prices that typically move to interpret the support and resistance to the system. You will need to understand the different types of support and resistance such as the major and the minor strong. The Minor levels are expected to be broken while the strong levels that hold the price that move to the other directions.

In Resistance and Support, most of the price action can be systematized into the patterns and movements. In the MT4 Platform pattern, there are support and resistance zones that form the trading and the range of the market movements. In this time prices make the swing high and lows, which resulting from the peak and troughs that can be marked as the resistance and support respectively. In this article, we will shed some light on most of the important types of support and resistance that every trader should know.

Traditional Swings High and Low

The Traditional Swing high and lows are one of the simplest ways for support and resistance. This is the term that is used to spot the higher time frames such as the daily, weekly, or even the monthly that where the currency price swing high and lower that made a swing low that turned higher.

By just drawing a horizontal line at the peak and trough, we can mark those value levels as help and obstruction zones. If it’s not too much trouble note that a few sources utilize the expressions “zones” while others use the expression “lines”. While backing and obstruction lines give a more exact value reading, advertises infrequently hit precisely that level. Or maybe, costs will in general trade the “zone” before breaking the zone or turning around.

Support and Resistance are dependent on conventional swing highs and lows have appeared on the chart.

It will identify the support and the resistance lines in which the chart moves to the daily chart to identify the further support and resistance that spotted the higher time frames and then zoom down the lower level to mark the zone that is visible time frames.

Swing Stepping Point Levels In Trends

The Swing Stepping is the support and resistance levels from the upwards and the downwards trends. It is one of the best ways to make levels.

Actually, with each break of a trend line during a downtrend, that helpline transforms into opposition and we can sit tight for a purported “pull-back” to that resistance line and along these lines enter a high-likelihood short position. Also, with each break of an obstruction line during an upswing, that opposition transforms in to help and we can enter a long situation on the accompanying pull-back.

This graph shows a downtrend with pull-backs that make sell openings. A few dealers may decide to sell promptly with the break of a support line, yet hanging tight for a drawback is generally a safer exchange. Besides, trying swing point levels can likewise be used for submitting a Stop Loss order. Basically, place your Stop Loss simply over a past support line for downtrends and under a past obstruction zone for upturns.

Risk Management and Containment

If the market begins to range, we can hope to exchange on swing point levels as control. After a past help or opposition line breaks, each fall near that past zone can be traded. An extra support line framed in the reach, which could act either as a benefit taking level or for the nearly closing of a position.

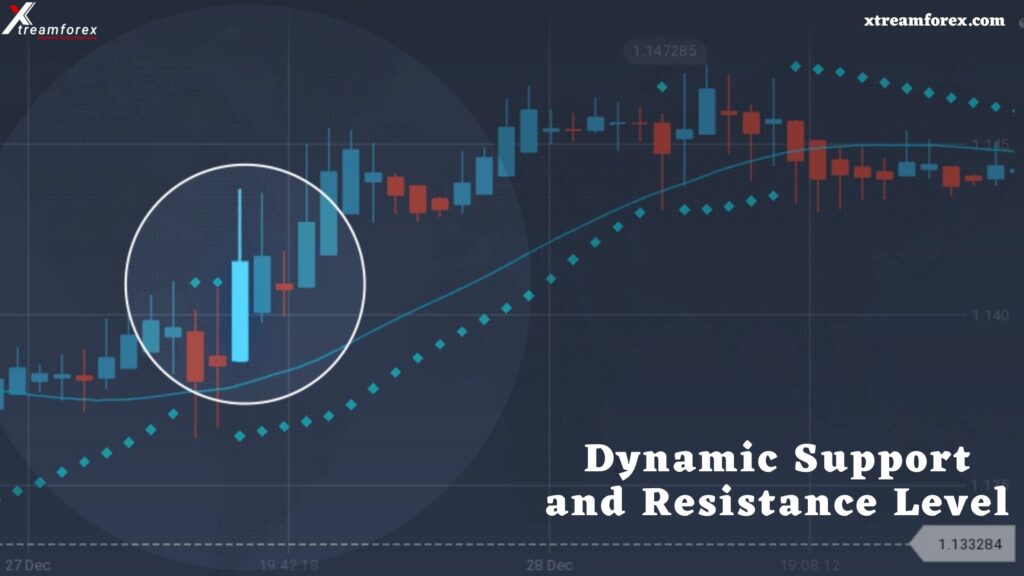

Dynamic Support and Resistance Level

Dynamic Support and Resistance levels are particularly interesting, in light of the fact that they move and change their levels with each new period. As their name suggests, those levels are dynamic and are drawn by moving averages. The normal settings for moving midpoints to go about as unique help and obstruction levels are 50-period MAs, 100-period MAs, and 200-period MAs. While basic moving midpoints can likewise be used in such a manner, exponential moving averages typically return better outcomes as they better record at the latest cost activity.

Dynamic help and obstruction levels are prominently used on the day by day time periods, however, can likewise be used on higher and more limited TFs. In any case, one significant thing to note is that less variable business sectors request EMAs with lower-period settings, for example, 50 periods or even lower; to represent the lower unpredictability and rapidly respond to little value developments.

Trading Range Support and Resistance

Ranging and compressing markets can likewise offer incredible trading openings. In a running business sector, we can essentially compromise the bob the upper obstruction line and the lower uphold line, and these levels can likewise be used for putting Stop Loss levels simply over the opposition line or just below the support level.

Markets can move in patterns, unite, and range. We have just secured how to recognize and trade backing and obstruction zones in moving business sectors (Stepping swing point levels in patterns), and now we’ll understand how to trade them range-bound business sectors.

Conclusion

Support and Resistance levels are basically past value zones where the cost experienced issues breaking above (obstruction) or below (uphold) that level. All the previously mentioned sorts of supports and protections in this article are only subsidiaries of this fundamental reason. Another significant idea to recollect is that once a help zone gets broken, it turns into an obstruction zone. Also, when an obstruction zone gets broken, it turns into a Support level. Most of the Top Trusted Forex Broker provides you an advanced trading platform in which you can place your trading indicators with several indicators.